Venture Capital

If, for the development of your company, you need more financial resources than your friends or banks can offer, or if you have not received any subsidies from structural funds, there are other possibilities for financing your innovative project.

Venture capital represents financial resources serving for investment in very rapidly growing, innovative projects, and is based on the investor’s entry into the selected enterprise through increasing its basic capital. This financial instrument is offered by venture-capital funds. A fund enters into an enterprise and provides it with the necessary capital, by which it gains an appropriate, generally minority share. Besides financial resources, the investor also brings an active approach to the running of the company in the form of strategic, trade and financial consulting. Such an investment should support the company’s advancement to the next phase of its development and contribute to the growth of its market value. The investor also determines the planned exit from the company, which is generally realised through the sale of the investor’s share to another investor or, as the case may be, to the original owner of the firm. The term “venture capital” is often understood as “risk capital” – in this case, primarily the investor incurs risk because the financial resources are mostly invested in firms’ projects in the early phases of their life-cycle or during the given firm’s expansion. Both variants represent the unverified possibility of the firm’s growth, which means that the planned appreciation of the financed project, i.e. the investment, may not occur. Thus, the investor takes on greater risk associated with the implementation of the project and expects substantial appreciation in the form of future revenues.

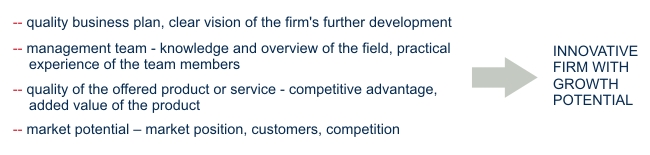

What concerns venture-capital funds in connection with implementation of the investment?

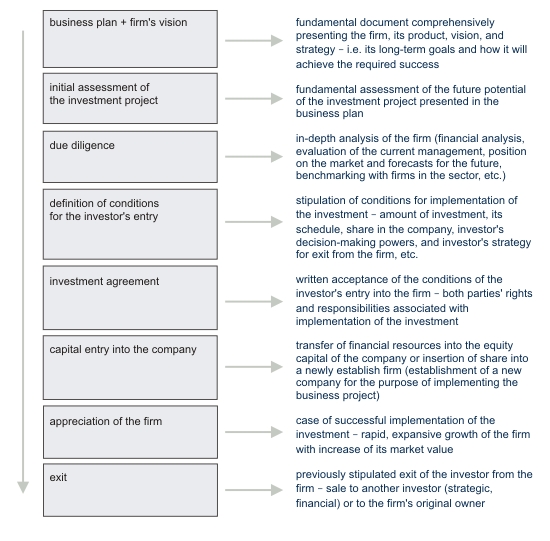

How does the investment process work – process of preparation and implementation of the investment?

A range of foreign and Czech private-equity investors operate in the Czech Republic within the Czech Venture Capital Association. More detailed information on the development of the Czech venture-capital market, possibilities of financing and individual venture-capital funds is available at www.cvca.cz.

In order for this form of financing to be used more in future by firms which due to their short history cannot obtain financing from banks or in the form of subsidies, a set of instruments has been prepared which will give small and medium-sized enterprises better access to alternative sources of financing. Within the Operational Programme Enterprise and Innovation, new activities are currently being prepared – the Jeremie initiative focused on the use of new non-subsidy financial instruments for the support of innovative projects of firms in the start-up or growth phase of business associated with higher risk of implementation. This concerns an instrument of the European Commission and European Investment Fund for the support of venture capital, micro-loans and guarantees for small and medium-sized enterprises. It is currently in the preparation phase, including mapping of the situation in the Czech Republic with the aim of determining the needs of small and medium-sized enterprises in this area.