Amendment to Act on Investment Incentives Spurs Inflow of Projects

21 Jan. 2013 | CzechInvest, Ministry of Industry and Trade | CzechInvest has received 41 new projects valued at CZK 19 billion since july 2012

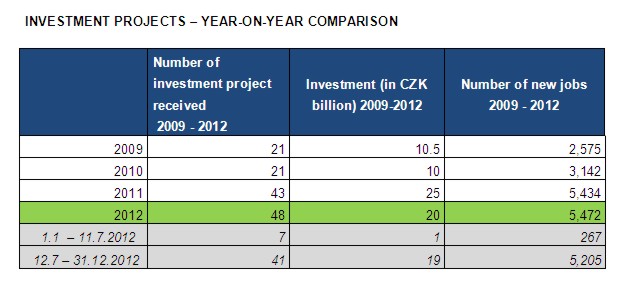

From January to 11 July 2012 CzechInvest received seven investment-incentives applications. In contrast with that figure, the agency received a total of 41 applications between 12 July and the end of last year. This figure represents an increase of five investment projects over the total for 2011 and 27 more than in 2010. The watershed moment was the adoption of an amendment to the Investment Incentives Act, which came into force on 12 July 2012 and for which firms such as ŠKODA Auto a.s., Saar Gummi Czech s.r.o, TŘINECKÉ ŽELEZÁRNY, a.s. and Jotun Powder Coatings (CZ) a.s. had been waiting.

“This shows that the amendment to the Investment Incentives Act was a step in the right direction and that the Czech Republic is competitive,” says Minister of Industry and Trade Martin Kuba. “The investment projects received last year represent CZK 20 billion and nearly 5,500 new jobs, the greater part of which in regions with high unemployment, such as the Ústí, Moravia-Silesia and Olomouc regions.”

“In 39 cases this involved expansions of existing firms; otherwise, these are investors who are investing in the Czech Republic for the first time or who established an additional, completely new business here. This trend indicates that we have succeeded in attracting investments with long-term potential. Investors are coming to the Czech Republic and developing their business here, and not only in manufacturing, but also in research and development,” adds Petr Očko, acting CEO of CzechInvest and head of the EU Funds, Research and Development Section at the Ministry of Industry and Trade.

The largest number of investment projects submitted in 2012 were in the automotive industry (19), plastics and rubber sector (7) and mechanical engineering and the metalworking industry (6). These generally involve manufacturing projects, whereas two investors are planning to construct technology centres in the Czech Republic and two projects involve shared-services centres. In the event of approval, the largest number of investment projects will be located in the Ústí (9), Moravia-Silesia (7), Central Bohemia (7) and Olomouc (5) regions.

CzechInvest is currently in talks with an additional five investors that are considering submitting investment projects during the first two months of 2013.

What has changed

Both existing and newly incoming investors in the manufacturing industry, business support services and technology centres can receive tax relief for a period of ten years instead of five years. The possibility to draw tangible aid for job creation, training and retraining, and the investment incentive in the form of transfer of land and related infrastructure for a favourable price remain unchanged.

A completely new aspect consists in the introduction of the institution of strategic investment events. This means that, besides standard investment incentives, designated projects can receive tangible aid for capital investment in the amount of 5% of costs. This support pertains to the manufacturing industry and technology centres. The Government of the Czech Republic issues decisions on support for individual projects that fulfil the relevant conditions.

Investment incentives in the Czech Republic are mediated exclusively by CzechInvest.

More information is available at http://www.czechinvest.org/en/investment-incentives-new.

For more information please contact the CzechInvest Press Centre

Adéla Tomíčková, spokesperson, phone: +420 296 342 832, adela.tomickova@czechinvest.org

Contact to Ministry of Industry and Trade:

Veronika Forejtová, spokesperson , phone: +420 224 853 291, forejtova@mpo.cz